Overview

Bespoke Funding is a proprietary firm that provides traders with unique funding opportunities. Established on September 26, 2022, the company offers three funding options and operates from its main office located at Gemma House, Lilestone Street, London, England NW8 8SS.

With the ability to open accounts with balances of up to $500,000 and profit splits of up to 80%, Bespoke Funding aims to support traders in accessing capital for their trading activities. Collaborating with Eightcap, a reputable broker, further enhances the trading experience.

Who are Bespoke Funding?

Bespoke Funding emerged onto the financial scene on the 26th of September, 2022, as a distinctive proprietary firm with a clear mission. Their unique approach caters to traders, presenting them with a choice between two exclusive funding programs: the Classic and the Rapid two-step evaluation programs.

Situated in the bustling heart of London, Bespoke Funding extends a welcoming hand to traders, offering them the potential to manage account balances of up to $400,000. What sets them apart is their generous profit splits, granting traders a remarkable 80% of the gains they earn.

In strategic partnership with esteemed brokers Eightcap and ThinkMarkets, Bespoke Funding ensures a seamless trading experience for their clientele. Their headquarters can be found at the esteemed Gemma House, nestled on Lilestone Street in London, England, bearing the postcode NW8 8SS. It’s here that Bespoke Funding brings together a blend of expertise, cutting-edge programs, and a commitment to empowering traders on their financial journey.

Who is the CEO of Bespoke Funding?

The CEO of Bespoke Funding is Zak Wilding. He, along with Lewis Kaler, co-founded the company. While we currently have information about Zak Wilding and Lewis Kaler as co-founders, we look forward to providing more details about their other co-founders in the near future. Stay tuned for further updates on Bespoke Funding and its leadership team.

Why You Should Consider Bespoke Funding

Bespoke Funding stands out as a prop firm that offers traders the opportunity to access capital without the need for significant personal financial resources. Whether you are an experienced trader looking to enhance your performance or a novice seeking a trusted partner, Bespoke Funding provides the expertise, support, and resources necessary to succeed in the competitive world of trading. Their range of funding options and profit splits of up to 80% make it an attractive choice for traders seeking financial backing.

Steps to Get Funded

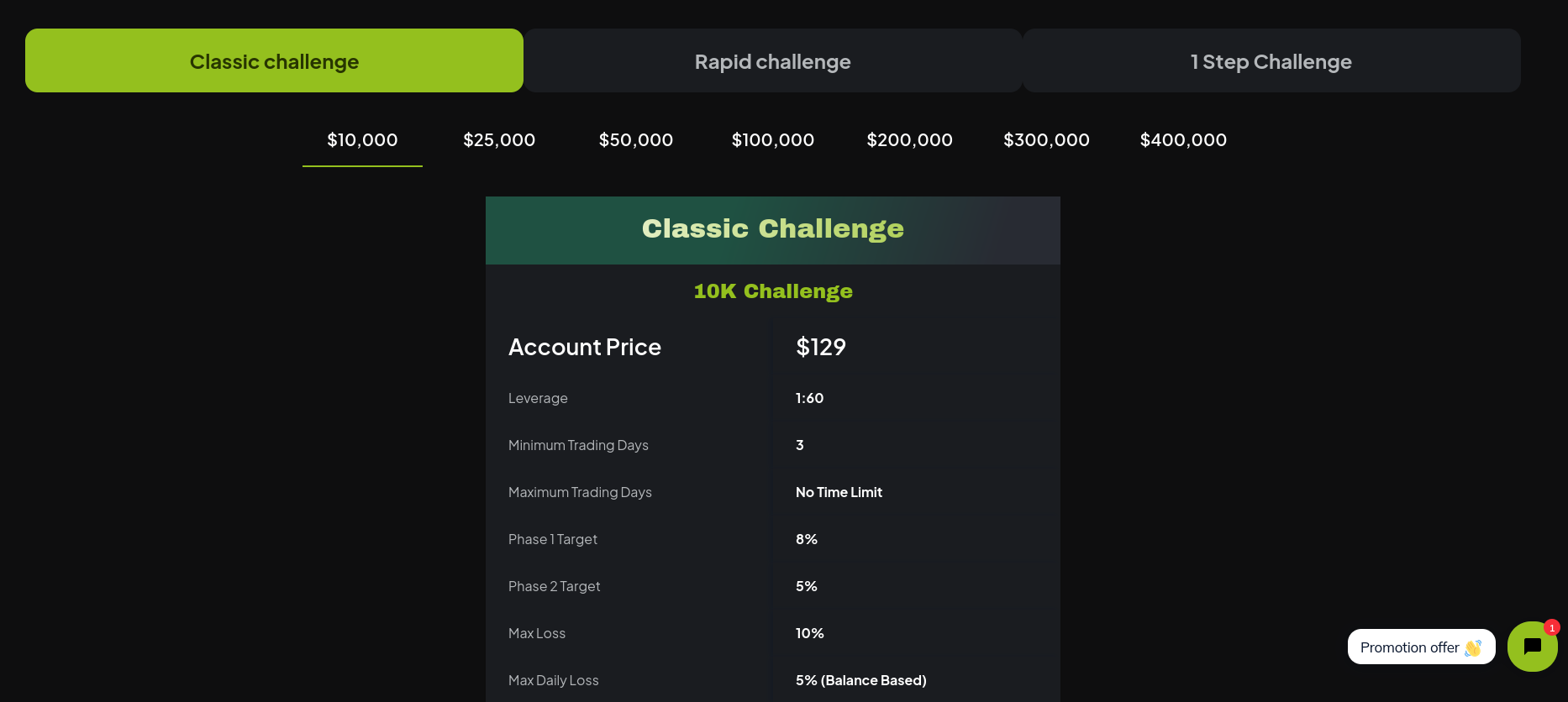

Bespoke Funding offers three funding options, namely the Classic Challenge Account, Rapid Challenge Account, and One-Step Challenge Account. Each option has its own evaluation process and specific requirements. Traders need to demonstrate their skills and reliability by meeting profit targets and adhering to loss limits during the evaluation phase. Successful traders gain access to a funded account without predetermined profit goals, allowing them to focus on their trading strategies.

Bespoke Funding’s Scaling Plan

Bespoke Funding’s scaling plan enables traders to progress from the evaluation phase to funded accounts. Once traders pass the evaluation process and gain access to a funded account, they can trade with larger capital sizes and potentially increase their profit potential. This scaling plan allows traders to manage significant portfolios and grow their trading activities with the support of Bespoke Funding.

Trading Instruments

Bespoke Funding offers a diverse range of trading instruments, each representing a unique facet of the financial markets. These instruments allow traders to engage with various assets, each with its own set of characteristics and profit potential. Let’s take a closer look at each of them:

Forex Pairs:

The foreign exchange market (Forex) is the world’s largest financial market, where currencies are traded. Traders engage in pairs, meaning they speculate on the relative value of one currency against another. For instance, EUR/USD represents the Euro against the US Dollar. Forex trading is known for its high liquidity and constant activity, providing ample opportunities for traders to profit from currency fluctuations.

| USDCHF | GBPUSD | EURUSD | EURJPY | USDCAD | |

| AUDUSD | EURGBP | EURAUD | EURCHF | EURJPY | GBPCHF |

| CADJPY | GBPJPY | AUDNZD | AUDCAD | AUDCHF | AUDJPY |

| CHFJPY | EURNZD | EURCAD | CADCHF | NZDJPY | NZDUSD |

| GBPAUD | GBPCAD | GBPNZD | NZDCAD | NZDCHF | EURHUF |

| EURCZK | EURDKK | ERUHKD | EURNOK | EURPLN | EURSEK |

| EURTRY | EURZAR | GBPDKK | GBPNOK | GBPSEK | NOKSEK |

| USDCNH | USDCZK | USDDKK | USDHKD | USDHUF | USDILS |

| USDMXN | USDNOK | USDPLN | USDRUB | USDSEK | USDSGD |

| CADSGD | USDTRY | USDZAR | EURSGD |

Commodities:

This category encompasses a wide range of physical goods such as gold, silver, oil, agricultural products, and more. Trading commodities allows investors to speculate on the future price movements of these essential resources. For example, an investor might trade gold in anticipation of geopolitical events or oil due to changes in global demand.

| XAUUSD | XAGUSD | XPTUSD | COPPER | NGAS |

| UKOil | USOil |

Indices:

Indices are essentially baskets of stocks that represent a specific market or sector. For instance, the S&P 500 is an index that tracks the performance of 500 of the largest companies listed on stock exchanges in the United States. Trading indices provides exposure to broader market trends, allowing investors to capitalize on the overall performance of a particular market or sector.

| US30 | SPX500 | DAX | US30 | UK100 |

| ESP35 | JPY225 | FRA40 | EUSTX50 | NAS100 |

Cryptocurrencies:

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin, Ethereum, and other altcoins are examples. Cryptocurrency trading has gained immense popularity due to its high volatility and potential for substantial gains. It offers an alternative to traditional financial systems and allows for decentralized transactions.

| BTCUSD | XRPUSD | DASHUSD | EOSUSD | ETHUSD | |

| IOTAUSD | LTCUSD | NEOUSD | OMGUSD | XMRUSD | BCHUSD |

| BNBUSD | BATUSD | ETCUSD | TRXUSD | XLMUSD | ZECUSD |

| DOGEUSD | SHBUSD1000 | ADAUSD | SOLUSD | DOTUSD | AVAUSD |

Bespoke Funding’s unique offering lies in its leverage options. Depending on the funding program chosen, traders can access leverage ranging from 1:10 to an impressive 1:100. Leverage allows traders to control larger positions with a relatively smaller amount of capital. While it can amplify profits, it’s essential to use leverage judiciously as it also increases the potential for losses.

Trading fees

Trading commission:

| Assets | Fee Terms |

| FOREX | 4 USD / LOT |

| COMMODITIES | 0 USD / LOT |

| INDICES | 0 USD / LOT |

| CRYPTO | 0 USD / LOT |

Comparison Between Bespoke Funding and Other Prop Trading Firms

Bespoke Funding distinguishes itself in the world of prop trading with its Classic Challenge and Rapid Challenge accounts, offering traders unparalleled flexibility. Unlike most industry-leading prop firms, Bespoke Funding imposes minimal trading style restrictions, allowing traders to operate during news events, hold positions overnight, and trade on weekends (with some limits).

Example of comparison between Bespoke Funding & FundedNext

| Trading Objectives | Bespoke Funding | FundedNext (Stellar) |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited

Phase 2: Unlimited |

Phase 1: Unlimited

Phase 2: Unlimited |

| Profit Split | 80% | 90% |

The Classic Challenge account comprises a two-phase evaluation, with 8% and 5% profit targets in phases one and two, respectively. There are daily gain limits of 5% and loss caps of 10%, with a minimum of 3 trading days required in each phase. This account also features a scaling plan and stands out for its relatively lower profit targets and no maximum trading day restrictions compared to competitors.

Example of comparison between Bespoke Funding & Blue Guardian

| Trading Objectives | Bespoke Funding | Blue Guardian (Unlimited) |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 8% | 8% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited

Phase 2: Unlimited |

Phase 1: Unlimited

Phase 2: Unlimited |

| Profit Split | 80% | 85% |

In summary, Bespoke Funding’s funding options strike a unique balance between freedom and structure, setting it apart as an attractive choice for traders seeking flexibility and potential growth.

Payment Proof

On September 26, 2022, Bespoke Funding was formally established. Traders with Classic and Rapid accounts can request their first withdrawal after 14 calendar days, and subsequent payouts are made every two weeks. In contrast, traders can request their first withdrawal from one-step challenge accounts whenever they like, with subsequent payouts calculated over the course of 30 calendar days. It’s important to keep in mind that after any of the three funding projects has been approved, there are no predetermined profit requirements before a payout can be requested.

The “Payout Proof” section of Bespoke Funding’s Discord channel is the best place to find examples of successful payouts.

Subscription & Profit Withdrawal Methods

Bespoke Funding has 3 subscription types according to their account types. The Classic Challenge starts from $129, Rapid Challenge begins from $99 and 1 Step Challenge starts from $315. Bespoke Funding offers convenient withdrawal methods to facilitate seamless transactions. While specific details may vary, traders can expect a range of options such as bank transfers, credit/debit cards, and electronic payment systems. The firm prioritizes providing secure and efficient payment processes to ensure a smooth trading experience for its traders.

Brokers Used by Bespoke Funding

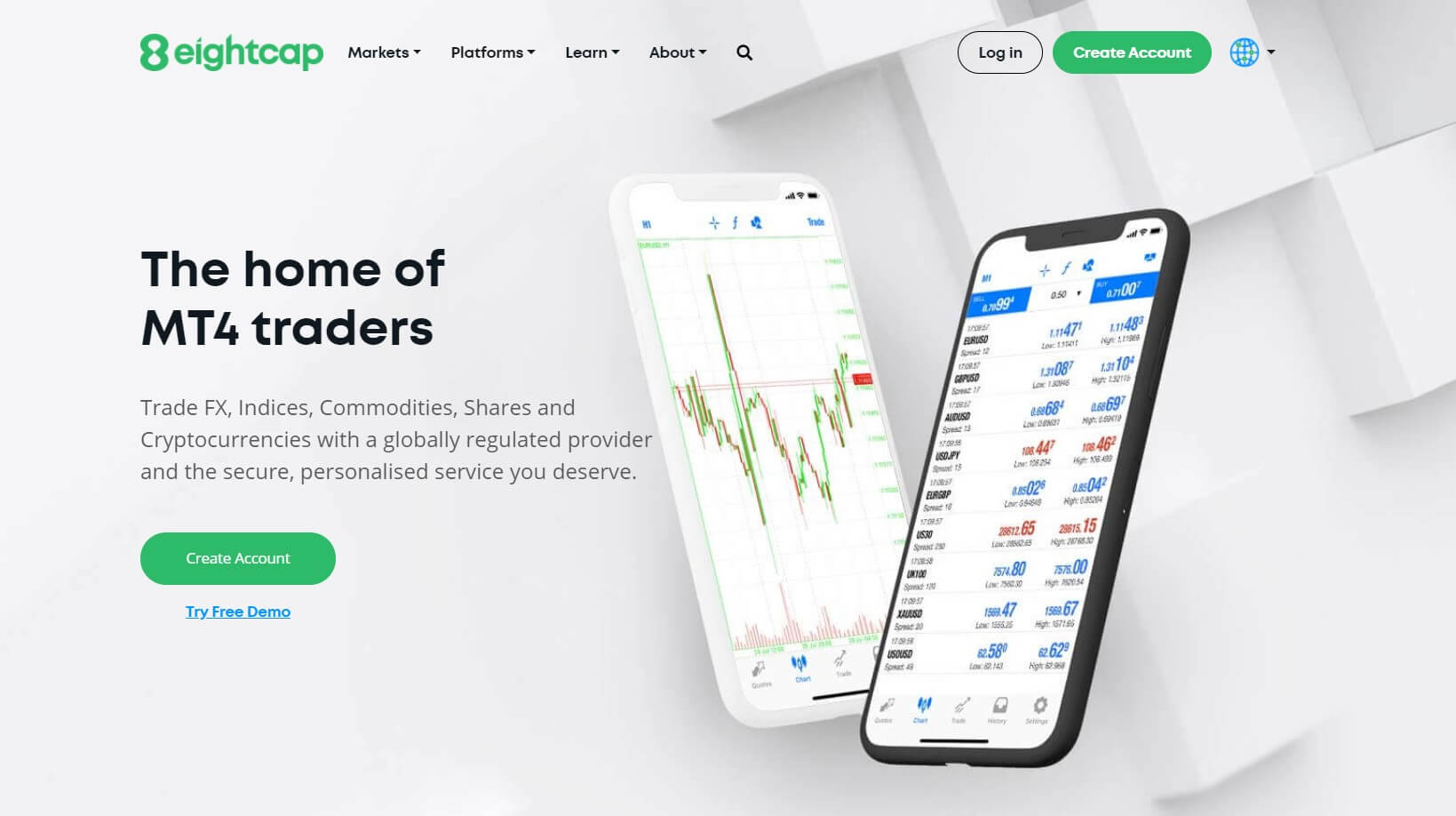

Bespoke Funding has partnered with Eightcap, an ASIC-regulated broker based in Melbourne. With a focus on providing excellent financial services, Eightcap offers trading in foreign exchange (FX), indices, commodities, and equities. Traders benefit from a range of trading instruments and platforms, including MetaTrader 4 and MetaTrader 5. Eightcap’s recognition as the Best Global Forex MT4 Broker in 2020 demonstrates their commitment to providing personalized service and cutting-edge technologies.

Traders’ Opinion

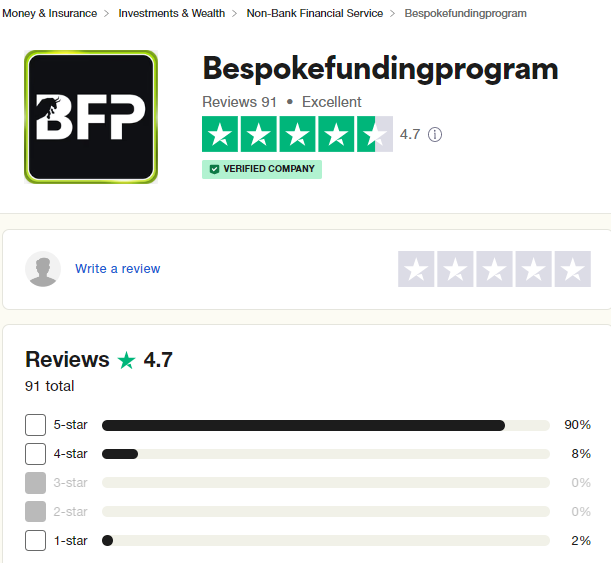

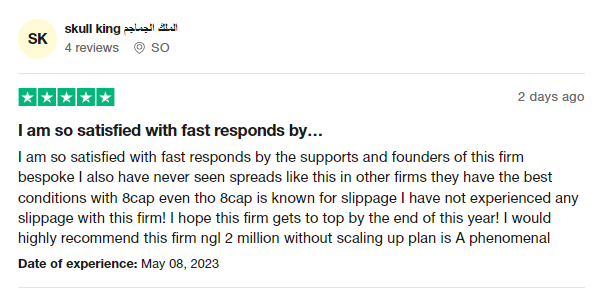

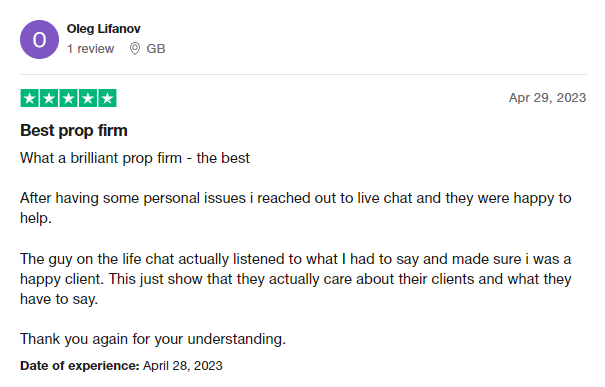

Traders’ opinions of Bespoke Funding are overwhelmingly positive. Trustpilot reviews, with a mean score of 4.7 out of 5 stars after 91 reviews, highlight the efficiency of Bespoke Funding’s support staff and the favorable trading conditions provided by their partner broker, Eightcap. The responsive customer support and genuine concern for clientele demonstrated by Bespoke Funding are commendable qualities in a proprietary trading organization. The supportive trading community and availability of live chat support contribute to a positive trading experience.

1.

2.

Customer Support at Bespoke Funding

When it comes to providing top-notch customer support, Bespoke Funding goes above and beyond to ensure that their clients receive the assistance they need. Here are some of the ways they make your experience as smooth as possible:

FAQ Page for Quick Answers

Bespoke Funding understands that sometimes you just need a quick answer to your questions. That’s why they’ve set up a comprehensive FAQ page where you might find the missing information. Whether you have inquiries about their services, application process, or anything else related to Bespoke Funding, this resource is there to help you.

Multiple Contact Options

If you can’t find the information you’re looking for on the FAQ page, don’t worry. Bespoke Funding offers various ways to get in touch with their support team. You can reach out to them via their social media channels, ensuring that you can connect with them through a platform you’re comfortable with.

Alternatively, for a more direct approach, you can email them at support@bespokefundingprogram.com. Their support team is prompt in responding to emails and can provide you with the specific assistance you require.

Live Chat Support for Real-Time Help

Sometimes, you need assistance in real-time, especially if you have urgent questions or concerns. Bespoke Funding understands this and has an active live chat support team available on their website. So, whenever you find yourself in need of immediate help, simply head to their website and initiate a chat. Their knowledgeable support agents are ready to assist you promptly.

Final Thoughts

Bespoke Funding, with its personalized strategies, commitment to excellence, and proven track record, stands out as a standout prop trading firm. Whether you are an experienced trader or a novice, Bespoke Funding offers the expertise, support, and resources necessary to succeed in the competitive world of trading. The range of funding options, collaboration with reputable brokers, and positive feedback from traders make Bespoke Funding a compelling choice for those seeking financial backing for their trading activities.