Blue Guardian redefines the funding experience for traders with its user-friendly design, essential information, and state-of-the-art technology. Experience the best-in-class funding journey and embrace the innovative ideas of Blue Guardian.

Blue Guardian is a proprietary trading firm that offers traders the opportunity to invest up to $2,000,000 with 85% profit splits.

They trade in various markets, including foreign currency pairs, commodities, stock indexes, and digital currencies. Blue Guardian operates under the trading name Iconic Exchange Limited.

Who are Blue Guardian?

Blue Guardian, also known as Iconic Exchange Limited, is a prominent proprietary trading firm that was established in June 2019. This innovative company took a significant step by going public in September 2021, marking a pivotal moment in their journey. Since then, they have been providing aspiring traders with an exciting opportunity to work with substantial capital, offering balances of up to $2,000,000 with an impressive 85% profit split.

What sets Blue Guardian apart is their strategic partnership with Eightcap and Purple Trading Seychelles, both esteemed names in the financial industry. These partnerships provide traders with access to cutting-edge tools and a robust trading infrastructure, ensuring a seamless trading experience.

Headquartered at 2 Highlands Court, Cranmore Avenue, Solihull, West Midlands, England, B90 4LE, Blue Guardian boasts a strong presence in the heart of England. This location serves as their base of operations, from which they extend their reach to traders around the world.

Who is the CEO of Blue Guardian?

The CEO of Blue Guardian is Sean Baiton. Sean brings a wealth of experience and expertise in the field of proprietary trading firms, making him a standout leader in the industry. His journey through the world of trading has spanned several years, and he’s honed his skills to perfection.

With an insider’s perspective on the proprietary trading firm sector, Sean offers a diverse range of trading services under his guidance. These services encompass everything from providing signals for trading to harnessing the power of machine learning and quantitative analysis to develop cutting-edge trading bots.

Sean’s role at Blue Guardian is pivotal, as he steers the ship towards its short and long-term goals. His vision and leadership have been instrumental in shaping the company’s direction and ensuring the successful execution of its mission. Thanks to his dedication and strategic acumen, Blue Guardian has solidified its position as a trusted name in the trading world.

Why You Should Consider Blue Guardian

Blue Guardian provides a professional growth opportunity for disciplined individuals who prioritize risk management and consistency. They offer favorable terms, including achievable profit targets and reasonable loss limits. With the potential to earn 85% profit splits and the opportunity to scale accounts, Blue Guardian is an attractive option for traders looking for a prop firm.

Steps to Get Funded

To get funded by Blue Guardian, traders need to pass two evaluation phases. In the first phase, traders must earn an 8% profit within 40 calendar days while adhering to strict daily and overall loss limits. The second phase requires traders to make a 4% profit within 80 calendar days, with the same loss limits. Successful completion of both phases grants traders a funded account with no profit requirements.

Blue Guardian Scaling Plan

Once traders have obtained a funded account, there is no specific scaling plan mentioned. However, traders have the opportunity to invest up to $2,000,000, allowing for potential account growth.

Trading instruments

Blue Guardian offers a versatile array of trading instruments that cater to both novice and experienced traders. With Blue Guardian, you can access an impressive range of financial markets, each with its own unique characteristics and opportunities.

Forex pairs are a popular choice among traders, and Blue Guardian lets you trade them with up to 1:100 leverage. This means that for every dollar in your trading account, you can control up to $100 in the forex market. It’s a powerful tool for those looking to amplify their trading potential.

| USDCHF | GBPUSD | EURUSD | EURJPY | USDCAD | |

| AUDUSD | EURGBP | EURAUD | EURCHF | EURJPY | GBPCHF |

| CADJPY | GBPJPY | AUDNZD | AUDCAD | AUDCHF | AUDJPY |

| CHFJPY | EURNZD | EURCAD | CADCHF | NZDJPY | NZDUSD |

| GBPAUD | GBPCAD | GBPNZD | NZDCAD | NZDCHF | EURHUF |

| EURCZK | EURDKK | ERUHKD | EURNOK | EURPLN | EURSEK |

| EURTRY | EURZAR | GBPDKK | GBPNOK | GBPSEK | NOKSEK |

| USDCNH | USDCZK | USDDKK | USDHKD | USDHUF | USDILS |

| USDMXN | USDNOK | USDPLN | USDRUB | USDSEK | USDSGD |

| CADSGD | USDTRY | USDZAR | EURSGD |

Commodities, including precious metals like gold and silver, are also available for trading on Blue Guardian’s platform. Here, you can use leverage of up to 1:20, allowing you to participate in these markets with relatively lower capital.

| XAUUSD | XAGUSD | XPTUSD | COPPER | NGAS |

| UKOil | USOil |

If you’re interested in indices, Blue Guardian provides access to a variety of them with leverage of up to 1:50. Indices represent baskets of stocks from different sectors and regions, providing diversification opportunities and a broader market perspective.

| US30 | SPX500 | DAX | US30 | UK100 |

| ESP35 | JPY225 | FRA40 | EUSTX50 | NAS100 |

For those intrigued by the world of cryptocurrencies, Blue Guardian offers trading with up to 1:2 leverage. Cryptocurrencies can be highly volatile, and this leverage allows you to manage your risk while still capitalizing on price movements.

| BTCUSD | XRPUSD | DASHUSD | EOSUSD | ETHUSD | |

| IOTAUSD | LTCUSD | NEOUSD | OMGUSD | XMRUSD | BCHUSD |

| BNBUSD | BATUSD | ETCUSD | TRXUSD | XLMUSD | ZECUSD |

| DOGEUSD | SHBUSD1000 | ADAUSD | SOLUSD | DOTUSD | AVAUSD |

Trading fees

Trading commission:

| Assets | Fee Terms |

| FOREX | 6 USD / LOT |

| COMMODITIES | 6 USD / LOT |

| INDICES | 6 USD / LOT |

| CRYPTO | 6 USD / LOT |

Comparison Between Blue Guardian and Other Prop Trading Firms

When it comes to prop trading firms, Blue Guardian stands out in the crowd. What sets them apart from most industry-leading prop firms is their unique approach to funding programs and trading style freedom. Blue Guardian takes a different path by offering two distinct two-step funding programs, all while refraining from imposing strict regulations on your trading style. This flexibility allows traders to operate on their terms, even during critical market moments like news releases, overnight positions, and weekends.

Example of comparison between Blue Guardian & E8 Funding

| Trading Objectives | Blue Guardian | E8 Funding (Extended) |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 8% | 10% (Scaleable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited

Phase 2: Unlimited |

Phase 1: Unlimited

Phase 2: Unlimited |

| Profit Split | 85% | 80% |

Let’s delve into the specifics of Blue Guardian’s funding programs. The first one is the Unlimited Guardian Evaluation Program, which comprises two phases. In the initial phase, traders aim for an 8% profit target, followed by a 4% target in the second phase. While there are rules in place, such as a 4% maximum daily loss and an 8% maximum loss overall, Blue Guardian grants traders the liberty of choosing when and how often they trade. This freedom is a breath of fresh air compared to other industry-leading prop firms, which often impose rigid trading day requirements.

Example of comparison between Blue Guardian & FundedNext

| Trading Objectives | Blue Guardian | FundedNext (Stellar) |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited

Phase 2: Unlimited |

Phase 1: Unlimited

Phase 2: Unlimited |

| Profit Split | 85% | 90% |

On the other hand, the Elite Guardian Evaluation Program is another two-phase evaluation program offered by Blue Guardian. It shares similarities with the Unlimited program, including an 8% profit target in phase one and a 4% target in phase two. However, there are slight differences. In this program, traders must adhere to a 4% maximum daily loss but are allowed a 10% maximum loss overall. Additionally, there is a minimum trading day requirement of 5 calendar days. Despite these differences, Blue Guardian maintains its stance on trading day flexibility.

Compared to other top-tier prop firms in the industry, Blue Guardian’s profit targets may seem relatively low. However, their commitment to allowing traders more control over their trading style and schedule makes them a distinctive choice in the world of proprietary trading.

Payment Proof

After successfully completing the evaluation phases and earning profits, traders are eligible to request withdrawals. Blue Guardian provides evidence of payment, and traders can refer to their Telegram channel for payment verification.

Subscription & Profit Withdrawal Methods

Blue Guardian’s refundable fee starts from $97. Once you complete phase 2, it will automatically refund your subscription fee. It offer a variety of withdrawal methods. They facilitate payments through Deel, which includes options such as bank transfer, Deel card, Coinbase, PayPal, Payoneer, Revolut, and Wise. If Deel is restricted in your country, alternative methods such as bank transfer, Wise, PayPal, or cryptocurrency can be arranged.

Brokers Used by Blue Guardian

Blue Guardian has established partnerships with brokers Eightcap and Purple Trading Seychelles. These brokers provide trading platforms and access to various tradable instruments.

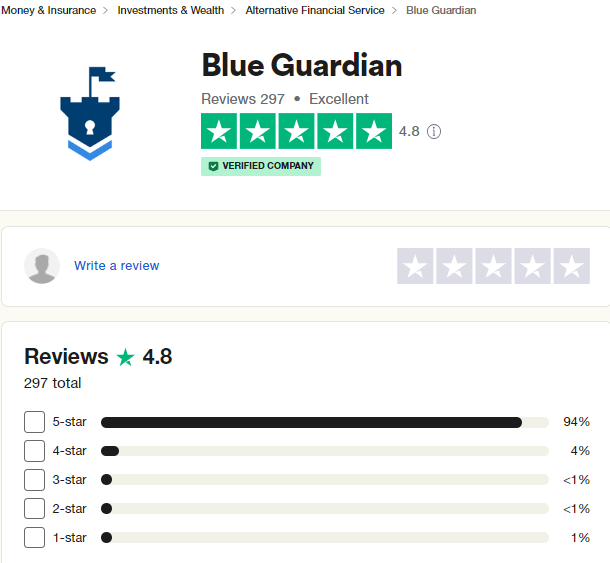

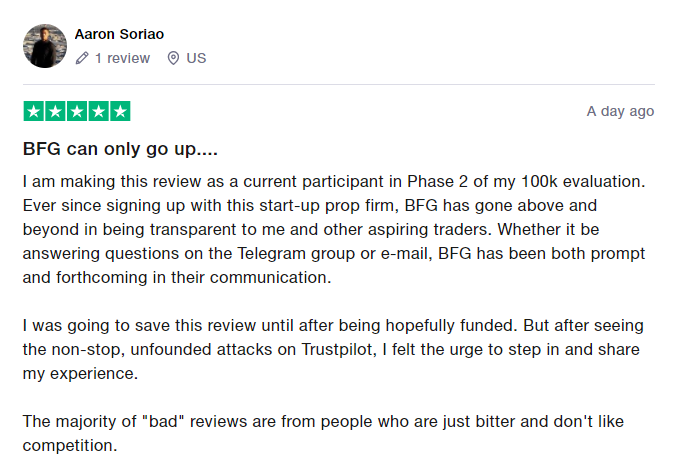

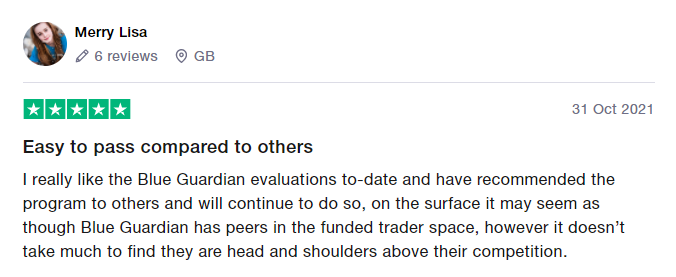

Trader’s Opinion

Traders have a positive opinion of Blue Guardian. The company has received high ratings and positive reviews on platforms like Trustpilot. Clients appreciate the clear and prompt responses they receive from Blue Guardian, and the evaluation phase requirements are seen as reasonable.

Customer Support at Blue Guardian

When it comes to customer support, Blue Guardian goes above and beyond to ensure a seamless experience for its valued customers. Whether you have a burning question or need assistance with an issue, they’ve got you covered.

FAQ Page:

Blue Guardian understands that sometimes, all you need is a quick answer to your query. That’s why they’ve set up a comprehensive FAQ page that covers a wide range of common questions and concerns. It’s the perfect place to start your troubleshooting journey and might just have the information you’ve been looking for.

Social Media and Email:

If you prefer a more personal touch, their friendly support team is just a message away. You can reach out to them via their social media channels for a prompt response. Alternatively, for a more traditional approach, you can send them an email at support@blueguardian.com. Rest assured, they’ll get back to you as soon as possible.

Live Chat Support:

For real-time assistance, look no further than Blue Guardian’s live chat support. Their team is available during business hours, from Monday to Friday, between 10 AM and 6 PM GMT+1. Whether you have a quick question or need help with a complex issue, their live chat support team is there to provide you with the assistance you need.

At Blue Guardian, customer satisfaction is a top priority, and their dedicated support team is committed to making your experience as smooth as possible. So, don’t hesitate to reach out whenever you need help or have a question – they’re here to assist you every step of the way.

Final Thoughts

Blue Guardian is a reputable proprietary trading firm that offers favorable terms to traders. With achievable profit targets, reasonable loss limits, and the potential to earn 85% profit splits, Blue Guardian provides a solid opportunity for traders seeking a prop firm. Their commitment to professional growth and positive community feedback further contribute to their reputation as a reliable option in the market.